Even before Northern Rock collapsed and the financial crisis exploded, Alistair Darling was already wrangling with an unenviable inheritance as chancellor of the exchequer.

Not only was he having to follow in the footsteps of the longest-serving chancellor of modern times – a man who presided over an almost unprecedentedly long period of stability and growing prosperity – he was doing so under the shadow of that same man.

After years of waiting, in June 2007 Gordon Brown had finally taken over as prime minister, and he had little intention of allowing anyone else to meddle with the economic plans he had laid out in his time at the Treasury.

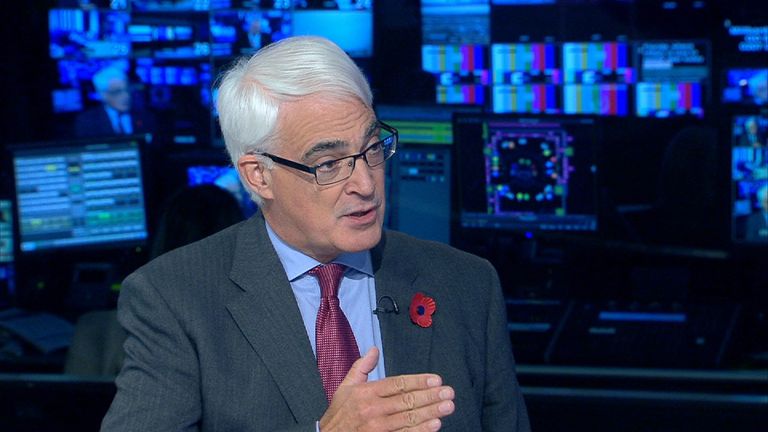

Most officials would have crumpled in the face of this task, but Darling was a consummate politician – a smooth, unshowy operator who rarely ruffled feathers, despite having led some of the most challenging departments in Whitehall.

He had been work and pensions secretary, transport secretary and trade secretary too.

Competent and capable, he was also, crucially, less cursed with ego than most of his counterparts.

And when he got the job it seemed quite likely that he would spend most of his time being overshadowed by the prime minister, but then, a couple of months in, Britain’s mortgage securitisation market froze.

Within a few weeks, Northern Rock was in big trouble.

By September, the high street lender was effectively finished, seeking emergency support from the Bank of England and triggering the first bank run since Victorian times.

Darling’s time in office would be defined by the financial crisis, by the collapse not just of Northern Rock but of other British banking icons, by the nationalisation of RBS and, more importantly still, the deep recession that followed.

This was a global financial crisis, but Britain, with its global banking system and strong dependence on the sector, was worse hit than most countries.

Read more:

Former chancellor dies aged 70

Westminster stunned by shock death of canny chancellor

The slump was deep and so too was the impact on Britain’s public finances.

Moreover, having managed and steered this system for more than a decade up until recently, there was no mistaking which politician was most responsible for Britain’s part in the malaise: the new PM.

Yet for most of his time in office Darling maintained his composure and attempted to clean up the mess without briefing about his predecessor’s part in it.

A scarred relationship with Gordon Brown

Tellingly, the moment that most scarred his relationship with Gordon Brown came when Darling warned that Britain was facing “the worst downturn in 60 years”.

While Darling suggested that crisis would be “more profound and long-lasting than people thought”, Brown believed (or wanted to believe) that it would all be over in six months.

There were furious briefings from “Gordon’s attack dogs”, as Darling later put it, suggesting that the chancellor had lost the plot. It was, Darling said, like the “forces of hell” had been deployed against him.

“I won’t deny,” he wrote in his memoirs some years later, “that this episode was deeply hurtful and that it shaped a difficult relationship for the rest of our term in office”.

The gentlemanly path

It was a telling moment in other respects. For it underlined what mattered most to Darling.

While Brown was desperate to avoid having to internalise or publicise the bad news facing the country, Darling was compelled to be honest.

While Brown would routinely use his press officials to brief against his opponents, Darling preferred to take the gentlemanly path.

But the rift that grew between No 10 and No 11 would in other respects prove a blessing to Alistair Darling. In the following years he grew in stature and independence.

No-one suggested in the months that ensued, as he implemented the tax cuts and then rises in the face of recession, that he wasn’t his own man.

And while it is hard to take much that is positive from this period in British history, it would arguably have been very different (and potentially far worse) had it not been for Alistair Darling.

Perhaps the most significant moment came when he resisted the pressure (including aggressive phone calls from the US Treasury Secretary Hank Paulson) for Barclays to take over Lehman Brothers as the American investment bank careered towards collapse.

How different Britain’s fate would have been had it absorbed Lehman’s toxic waste and instruments onto its balance sheet.

An elder statesman

After leaving office, Darling did much as he had while in office.

He tried to be the statesman. He led the Better Together campaign during the Scottish independence referendum.

He sat in the House of Lords until 2020. He did not shout from the side lines but very quickly became an elder statesman, respected and admired across political divides.

Perhaps his greatest legacy is something else, something quite intangible.

It is hard to think of many politicians who will be remembered with such affection – as a good man, a kind man.

His loss, so much earlier than expected, leaves British politics a sadder, somewhat less dignified place.