The world’s largest EV battery maker warned that it expects to report less revenue in 2024 than the previous year, sending share prices down on Wednesday. CATL (SHE: 300750) stock dipped after its 2024 Annual Performance Forecast was released. Here’s a preview of CATL’s financials for last year.

CATL stock falls on lower 2024 revenue expectations

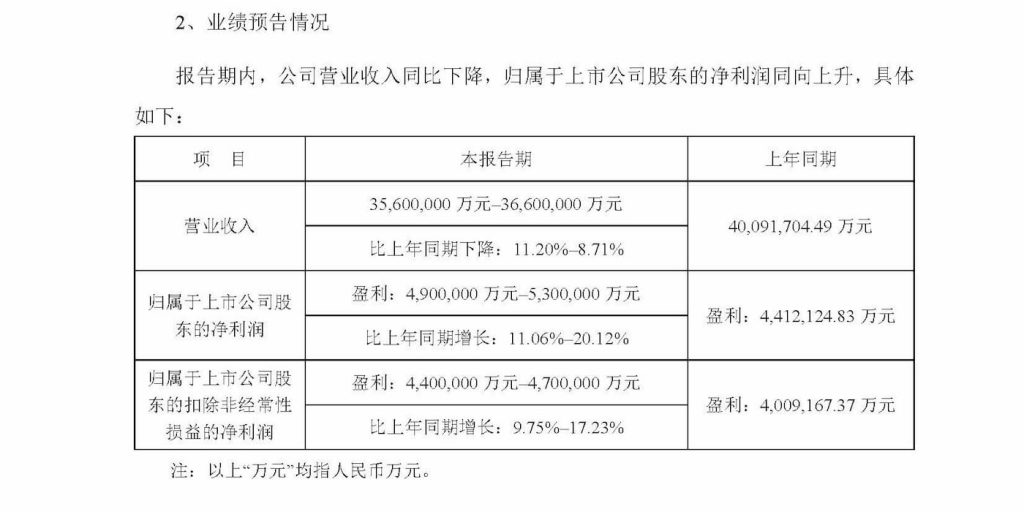

CATL released the forecast in a filing with the Shenzen Stock Exchange late Tuesday, previewing its full-year 2024 financials.

The battery giant expects annual revenue of between RMB 356 billion ($48.9 billion) and RMB 366 billion ($50.3 billion), suggesting an 11.20% to 8.71% decrease from 2023. This would mark CATL’s first time reporting lower annual revenue than the year before.

CATL said that although sales volume was up, the lower expectations were due to falling raw material prices, including lithium carbonate. Despite this, the company still expects to post annual net income of RMB 49 billion ($6.7 billion) to RMB 53 billion ($7.3 billion), which would be up 11.06% to 20.12% from 2023.

Excluding non-recurring gains and losses, CATL expects net profit attributable to shareholders between RMB 44 billion ($6 billion) and RMB 47 billion ($6.5 billion), up 9.75% to 17.23% from 2023.

CATL said the higher net profits were “mainly due to the company’s technological research and development capabilities.” It also said the competitiveness of its products continues to increase.

After launching a series of new products and technology while expanding its partnerships last year, CATL expects “steady growth” in performance.

Just yesterday, a local report from Jieman claimed CATL expected to announce plans for yet another EV battery plant in Europe as it expands its global reach. The new facility would be in addition to the one revealed last month with Stellantis and CATL’s fourth in Europe.

According to SNE Research, CATL remained the world’s largest EV battery maker, commanding 36.8% of the global market through the first 11 months of 2024.

CATL launched its new Bedrock Chassis last month, which it calls “the world’s first ultra-safe” EV skateboard chassis. It’s also aggressively expanding its EV battery swap plans with a new line of Choco-SEB batteries, which make swapping even quicker than filling a gas tank (within 100 seconds).

Despite the confidence and higher net profits, CATL’s stock slipped around 2% on Wednesday following the lower revenue expectations.

CATL shares are still up nearly 70% over the past 12 months, as the EV battery leader launched new products and expanded its global market lead.