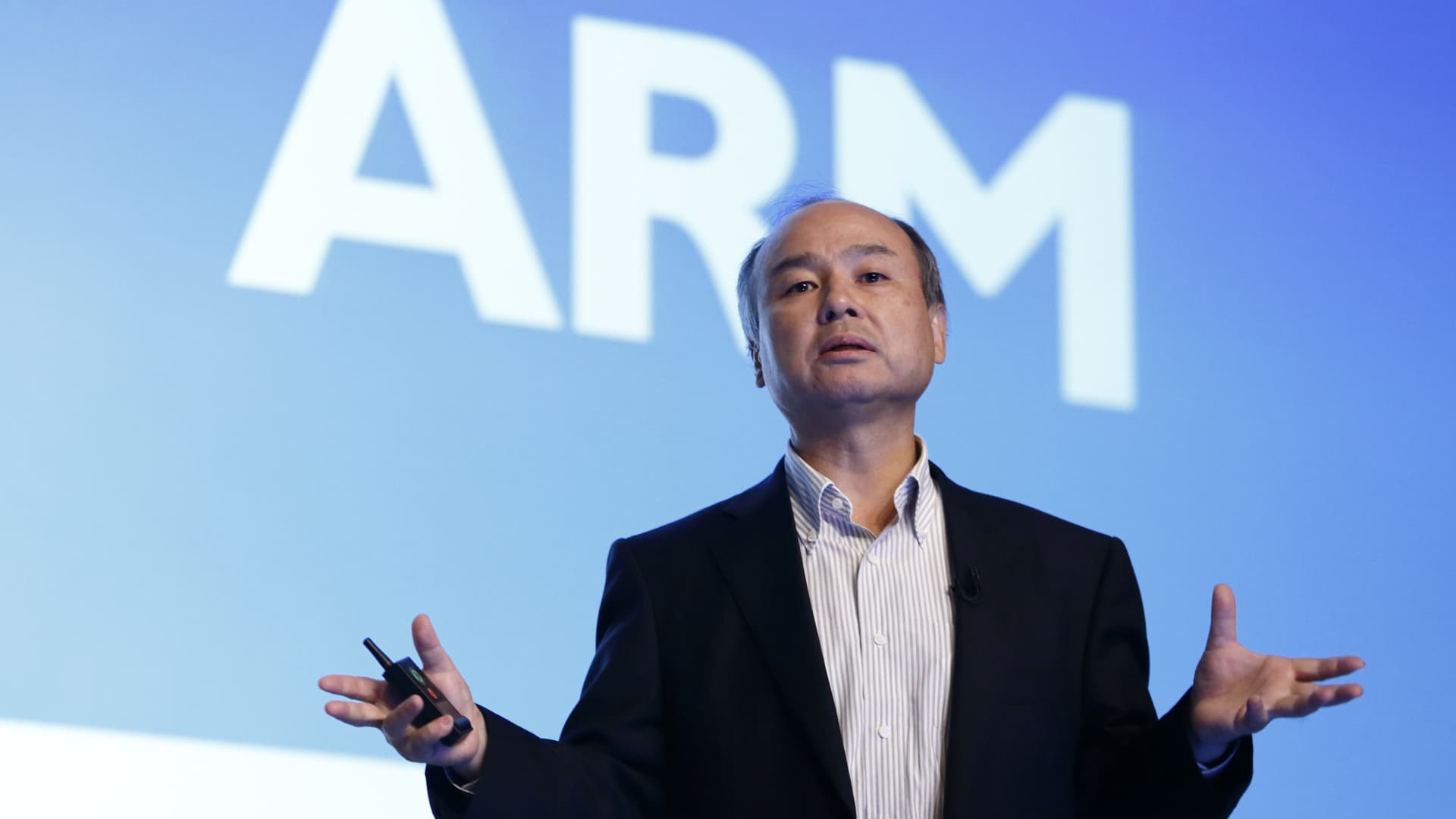

Masayoshi Son’s SoftBank made more in Arm’s after-hours trading on Wednesday than the total amount the company lost from its disastrous bet on now-bankrupt WeWork.

Arm shares rocketed as much as 41% late Wednesday after the chip designer reported revenue and earnings that sailed past analysts’ estimates. SoftBank took Arm public in September and still owns about 930 million shares, or roughly 90% of the chip designer’s outstanding stock.

Arm pared its initial gains, but SoftBank’s stake still jumped by almost $16 billion — from close to $71.6 billion to $87.4 billion — after the earnings report. Softbank acquired Arm in 2016 for $32 billion, and its shares were worth just over $47 billion at the time of the IPO last year.

The Arm windfall follows a rough stretch for SoftBank’s investment portfolio.

The company’s most high-profile wager was in WeWork, which spiraled into bankruptcy in November after the office-sharing company spent years burning through billions of dollars in cash from SoftBank at sky-high valuations. The Vision Fund, SoftBank’s venture arm, posted a $6.2 billion loss in the second quarter of 2023, tied to WeWork and other soured bets.

SoftBank told investors in November that its cumulative loss on WeWork exceeded $14 billion. In 2022, after a $32 billion loss in the Vision Fund, Son suggested that SoftBank would shift away from aggressive investments and into “defense” mode, selling down stakes in Alibaba and preparing to take Arm public. A little more than a year later, as hype over artificial intelligence mounted, Son said Softbank would switch back into “offense” mode, pursuing investments in AI.

Son can’t yet cash in on his company’s gains from Arm.

SoftBank is under a lock-up provision which prevents it from selling its Arm shares, with certain exceptions, for 180 days after the stock market debut. Arm went public in September, meaning that the lock-up restriction expires in mid-March.

WATCH: Masa Son flexes Arm