In its short 14-year history, GlobalFoundries has risen to become the world’s third-largest chip foundry. Based in upstate New York, GlobalFoundries isn’t a household name because it’s manufacturing semiconductors that are designed and sold by other companies.

But it’s quietly helping power nearly every connected device.

“Look at every electronic device in your house, and I would bet you money that every one of those devices has at least one GlobalFoundries chip in it,” Thomas Caulfield, GlobalFoundries CEO, told CNBC.

GlobalFoundries chips are inside everything from smartphones and cars to smart speakers and Bluetooth-enabled dishwashers. They’re also in the servers running generative artificial intelligence models, a market that’s booming so quickly that chipmaker Nvidia has surpassed a $1 trillion market cap and is forecasting 170% sales growth this quarter.

Within generative AI, GlobalFoundries isn’t focused on making the powerful graphics processing units (GPUs) used to train large language models like ChatGPT. Instead, the company is manufacturing chips that perform functions like power management, connecting to displays, or enabling wireless connections.

Caulfield says AI is “the catalyst for our industry to double in the next eight years and GF will have its fair share, if not more, of that opportunity.”

Five years ago, GlobalFoundries made a bold move away from leading-edge chips, exiting a race that was won by Taiwan Semiconductor Manufacturing Company.

Now, as tensions with China raise concerns over the world’s reliance on TSMC, and the U.S. and China play technological tug-of-war with export controls, GlobalFoundries finds itself positioned well outside the geopolitical crosshairs. The company has spent about $7 billion to expand production in Singapore, Germany, France and upstate New York.

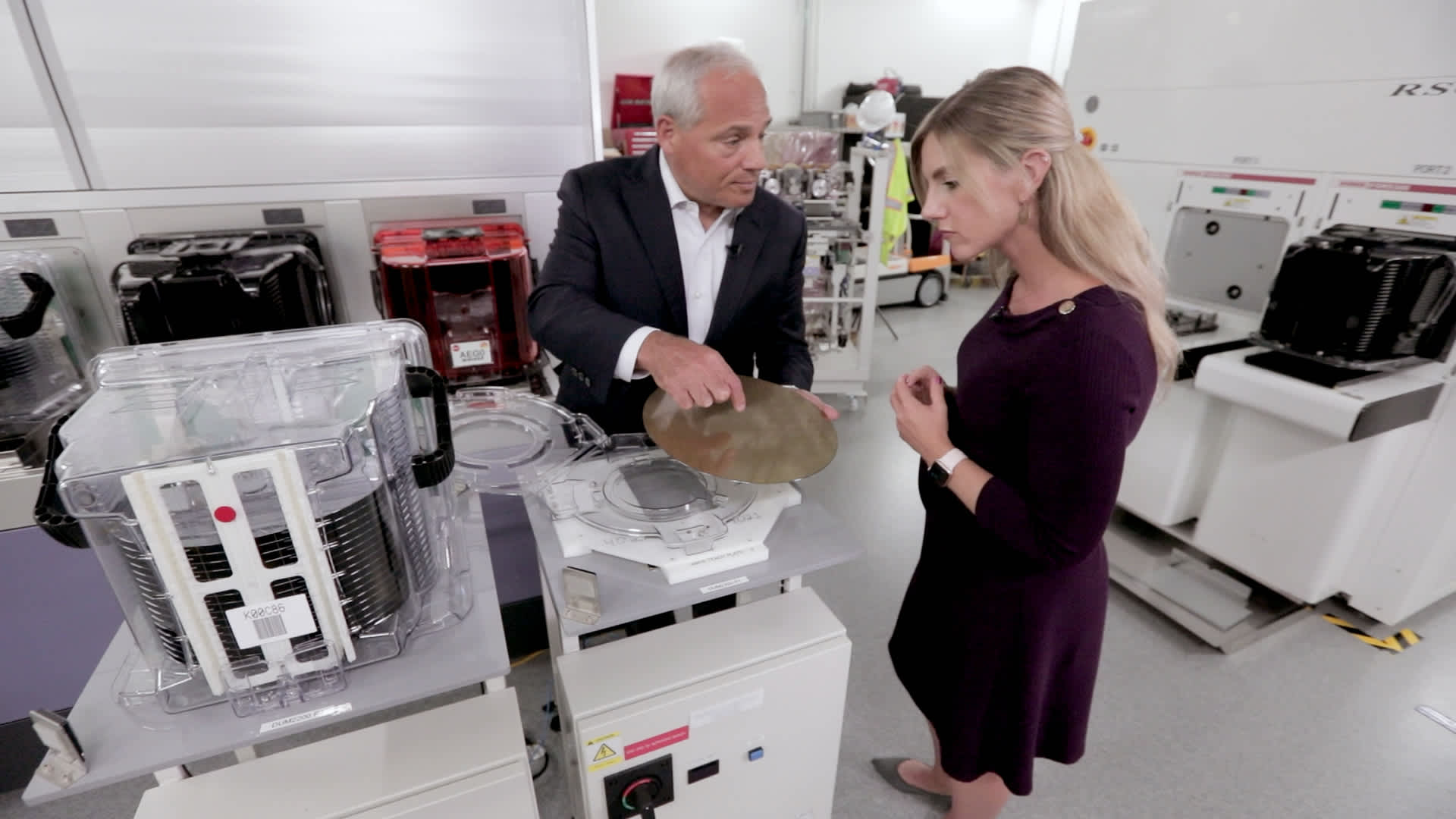

CNBC went to Malta, New York, for a firsthand look at the fabrication plant where GlobalFoundries is adding 800 acres, to ask how the company plans to stay ahead while developing the older chips still essential for everyday devices.

‘It worked out for everybody’

The story began in 2009, when Advanced Micro Devices decided to break off its manufacturing operations into a separate company and focus entirely on designing chips. The newly formed GlobalFoundries took over AMD’s chip fabrication plant, or fab, in Dresden, Germany. At the time, it was a joint venture between AMD and the government of Abu Dhabi’s tech investment arm. Moorhead was working at AMD.

“Our founder, Jerry Sanders, at AMD said, ‘real men have fabs.’ So the thought of spinning out the fab from AMD into its own company was a really big deal,” Moorhead said. AMD “had to do it,” he added, because “the expenses for a leading edge fab were doubling every two or three years. And right now we’re looking at investments of campuses upwards of $100 billion.”

For the first few years, AMD was GlobalFoundries’ only major customer. AMD has since grown to become Nvidia’s main rival for designing GPUs.

“I think it worked out for everybody,” Moorhead said.

GlobalFoundries started building its new fab, and future headquarters, in Malta in 2009. The next year, it expanded into Singapore with the purchase of Chartered Semiconductor. By 2015, it had acquired IBM‘s in-house semiconductor division, taking over production sites in Vermont and New York. By 2018, GlobalFoundries was a $6 billion business.

“Unfortunately, it had a strategy that was not able to produce profitability or free cash flow,” said Caulfield. “So in 2018, when I became the CEO of GlobalFoundries, we decided to make a strategic pivot to focus all our energy, all our R&D, all of our capital deployment to go be the very best at these essential chips. And that began a journey to turning our company around to profitability.”

To this day, GlobalFoundries only makes 12-nanometer chips and above, or what it calls “essential” chips.

“If you do secure pay transactions, whether it’s on your credit card or on your smart mobile device, we make the chip that does that,” Caulfield said. “Do you like the photographs your camera takes? Well, we make image sensor processors that drive that camera. Do you like the battery life on your phone? We make the PMICs, the power management ICs that make sure that power is managed on these devices.”

During the 2021 chip shortage, GlobalFoundries told CNBC it sold out entirely. That same year, the company went public on the Nasdaq.

“Ultimately, we really need these chips,” said Daniel Newman, CEO of research firm Futurum Group. “We found that out because we had parking lots full of pickup trucks that couldn’t be shipped because they couldn’t put the ECU in or they couldn’t install power seats. So GlobalFoundries had a really strong market requirement.”

Global growth

GlobalFoundries is the only one of the world’s top five chip foundries based in the U.S. The other four are Semiconductor Manufacturing International in China, Samsung with fabs in South Korea and the U.S., and United Microelectronics and TSMC, which are both in Taiwan.

“Not only do we have a high concentration of semiconductor manufacturing in Taiwan between TSMC and UMC, but TSMC is twice the size of the other four companies combined,” Caulfield said.

TSMC makes more than 90% of the world’s most-advanced microchips, creating vulnerability during supply chain backlogs as well as risks tied to China’s continued threats to invade Taiwan. Like GlobalFoundries, TSMC also makes older nodes. Caulfield said GlobalFoundries is absolutely going after TSMC.

“Not only do we have aspirations, we think in certain areas we’ve won,” Caulfield said. He pointed to his company’s radio frequency chips and silicon on insulator technology.

“Silicon on insulator is a huge differentiator when it comes to power, and TSMC doesn’t use that,” Moorhead said.

At a time of geopolitical turmoil, GlobalFoundries is investing about $7 billion to add capacity in parts of the world with lower risk.

In Singapore, the company just completed a $4 billion expansion that it says makes it the country’s most-advanced fab. In June, it finalized a deal with STMicroelectronics to build a jointly owned fab in Crolles, France.

Not all global expansion endeavors have gone smoothly, however. In 2017, GlobalFoundries made big plans for a fab in Chengdu, China. In 2020, it backed out.

“It turned out we had three relatively large facilities around the world already that were severely underloaded,” Caulfield said. “Adding more capacity at a time when we couldn’t fill our existing capacity was just going to create a bigger economic hole for us.”

The U.S. has recently enacted a series of export bans on chip companies sending advanced tech to China. By only producing older nodes, GlobalFoundries says it’s been “very minimally” impacted.

Making chips in the U.S.

Although GlobalFoundries’ chips are considered legacy nodes, the process and resources needed are still incredibly complex. Caulfield said each silicon wafer goes through at least 1,000 steps over 90 days in the Malta fab. The process requires extensive cleaning, cooling and chemical treatment, which uses a lot of water. GlobalFoundries says Fab 8 uses about 4 million gallons of water a day, reclaiming 65% of that.

“Upstate New York is a very good place for access to high-quality and abundant water,” Caulfield said.

All the heavy machinery also requires about 2 gigawatts of power per day, according to Hui Peng Koh, who heads up the Malta fab. She said it’s enough power to “run a small city.”

“I would say our lowest-cost power is in the U.S.,” Caulfield said. “A lot of our power in upstate New York, where this facility is at, comes from hydroelectric, so it’s a greener power. In both Europe and Singapore, much of that power comes off of natural gas.”

Then there’s the manpower. GlobalFoundries has 13,000 employees worldwide. About 1,500 people report to Koh in Malta. She told CNBC it’s “challenging to attract talent to this part of the world.”

GlobalFoundries recently established the first apprenticeship program that’s registered in the U.S. to help develop a semiconductor workforce in Vermont and New York. In July, TSMC blamed a shortage of skilled labor for delays to its fab being built in Arizona.

The high cost of materials and construction work also make building a fab in the U.S. more expensive than in much of Asia, so public subsidies have been key for reshoring production. GlobalFoundries said New York pitched in more than $2 billion for the Malta fab. The company also applied for funds from the $52 billion national CHIPS and Science Act. Focusing on 12-nanometer and above also helps the company keep costs down.

GlobalFoundries said it’s putting out 400,000 wafers per year from its Malta fab. While Caulfield wouldn’t put a dollar figure on the wafers, he said at any given time, there’s “about a half-billion dollars worth of inventory that’s running over those 90 days to create product.”

GlobalFoundries’ main customers for this massive output of essential chips are the world’s largest fabless chip companies, including Qualcomm, AMD, NXP and Infineon.

Eventually, many of its chips end up in the auto, aerospace, and U.S. defense industries.

GlobalFoundries is known for making “specialty chips” in big, exclusive deals, like one with Lockheed Martin in June for onshoring production of certain chips, and a recent $3 billion agreement with the U.S. Department of Defense.

Newman said GlobalFoundries has around 50 such long-term agreements.

“Effectively they’re saying, ‘We will create a stable margin commitment capacity and if the market shifts, we’re going to stand by the letter of our agreement,'” he said.

For companies hit hardest by the chip shortage, a deal with GlobalFoundries is a hedge against it happening again. In February, General Motors set aside exclusive production capacity at the Malta fab.

“GM, their lines got held up for very low-cost components because they couldn’t get enough,” Moorhead said. “What GM decided is that this is too much supply chain risk. We’re going to go directly to GF.”

GlobalFoundries says automotive is one of its fastest-growing segments. It makes many different kinds of chips for cars: the microcontrollers for power seats, airbags and braking; the sensing chips for cameras and Lidar; and battery management chips for electric vehicles.

Meanwhile, the growth of GlobalFoundries’ smartphone business is decelerating, alongside an industrywide slowdown. GlobalFoundries laid off 800 employees in December and January, and issued weaker-than-expected revenue guidance for the third quarter.

“Smart mobile devices last year represented 46% of our revenue,” Caulfield said. “While it grew last year, it was 50% the year before. So we’ve been trying to build our other business and to get more balanced, rather than having such a high exposure to smart mobile devices.”